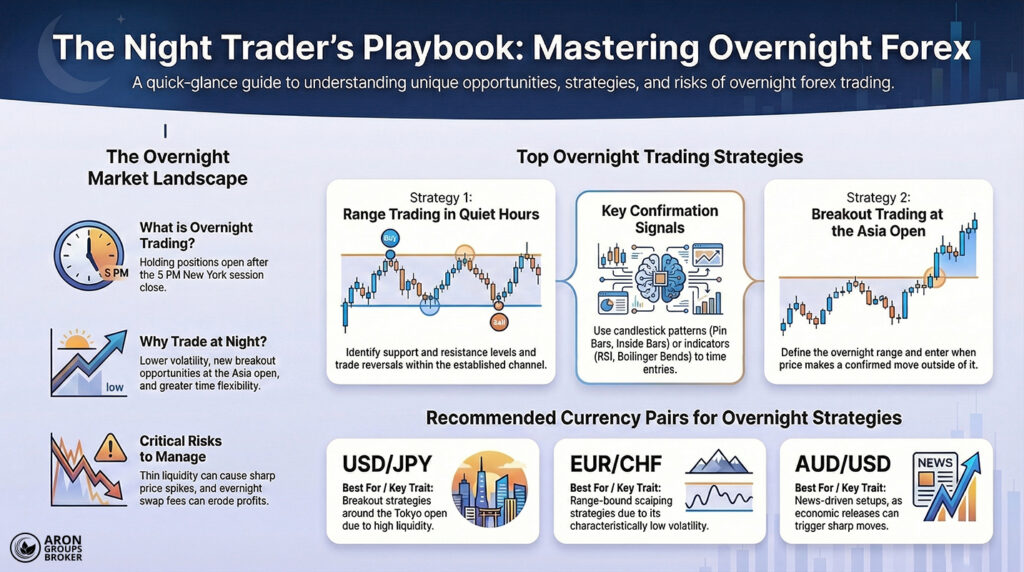

The forex market runs 24 hours a day, which gives traders a unique window for flexible participation. One of the most interesting parts is overnight forex trading, usually near the New York close and early Asia open. Many traders choose these hours because volatility often cools down, or fresh moves appear at the next day’s opening.

In this article, we explain overnight trading, its benefits, its risks, and practical strategies for this time window.

- Before trading overnight, check tomorrow’s economic calendar so major Asian events do not catch you off guard.

- Trade more actively at night because liquidity is thinner, and unexpected spikes can be sharper than you expect.

- Because the market is quieter overnight, price alerts help you notice setups without staring at charts nonstop.

- If you want better focus, night is ideal for testing new strategies on a demo account with low pressure.

- Emotional control matters more overnight, since slow movement can trigger rushed entries and unplanned overtrading.

What Is Overnight Trading in Forex?

As explained in Investopedia, overnight forex trading refers to positions that remain open after a trading session ends, or trades placed during low-activity hours. In the forex market, 5:00 pm New York time is considered the end of the trading day for many brokers. Any position that stays open after that time is treated as an overnight position and may incur swap charges. Swap, also called overnight financing, is the interest-like cost or credit applied for holding a leveraged position overnight.Why Is Overnight Trading Attractive?

Overnight forex trading can be attractive for several practical reasons, depending on your style and schedule.- Lower volatility: Late-night activity often drops, volume fades, and the price may spend more time ranging within tighter bands.

- New opportunities: When the Asian session opens, sudden breakouts can appear, especially after quiet consolidation near key levels.

- Useful for scalpers: Lower-volatility pairs can offer cleaner micro-moves, which suit fast, rules-based overnight scalping approaches.

- Time flexibility: For people who are busy during the day, overnight hours can be a realistic window for consistent trading.

Best Strategies for Overnight Forex Trading

In overnight forex trading, market volume and liquidity drop, so price behaviour differs from that during volatile European and US trading hours. In general, two key opportunity types appear most often during overnight trading conditions:- Limited moves (Range/Consolidation): These often form around midnight as price compresses inside a narrow band.

- Explosive moves (Breakout): These usually happen when the Asian session opens and liquidity returns.

Range Trading Strategy During Low-Volatility Hours

At night, many currency pairs move inside a range because there are fewer high-impact economic releases. In this situation, follow a simple and disciplined checklist to avoid noisy, low-quality entries.- Mark the overnight support and resistance levels clearly on your chart.

- Look for buy entries near support and sell entries near resistance, with clean confirmations.

- Place the stop loss slightly outside the range to reduce the damage from common false breakouts.

Using Price Action Patterns at Night

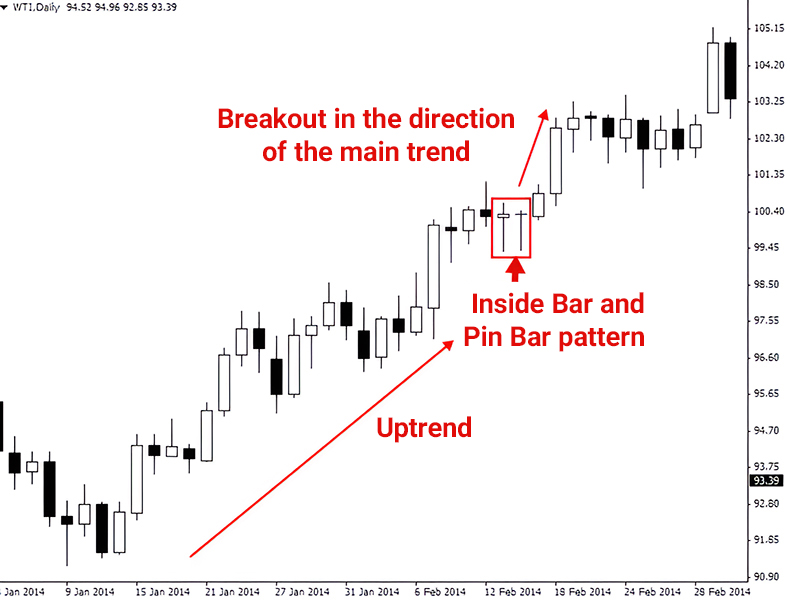

In calmer overnight markets, candlestick patterns are often clearer and easier to interpret than in fast sessions. The most important patterns to watch include the following classic setups.

- Pin Bar: Signals a sharp rejection from a level and often hints at a quick reversal.

- Inside Bar: Shows a pause in momentum and can precede a breakout in the next candles.

- Doji: Represents market indecision and appears very frequently during quiet nighttime conditions.

For example, a bearish pin bar forming near resistance can act as a practical sell signal.

Overnight Forex Trading With Technical Indicators (RSI, MACD, Bollinger Bands)

Indicators can help you make clearer overnight decisions when price moves slowly, and misleading signals are tempting. Used properly, they improve entry and exit timing, but they should not replace levels and context.- RSI: Identifies overbought and oversold conditions; above 70 overnight often increases pullback risk.

- MACD: Helps spot divergences; during low volatility, MACD price divergence can become a strong warning signal.

- Bollinger Bands: When bands squeeze tightly, it often signals an upcoming strong breakout move.

Overnight Scalping on Low-Volatility Currency Pairs

Scalping means taking fast, short-term trades that target small profits with strict risk control. At night, the best scalping pairs are:- EUR/CHF: Often shows small moves and relatively low spreads during quiet hours.

- AUD/NZD: Usually has limited volatility and can feel lower-risk than more reactive pairs.

- Choose a suitable timeframe: The 1-minute to 5-minute charts are common for clearly seeing micro-moves.

- Keep taking profit short: Expect small gains; many scalpers use about 5-10 pips for faster exits.

- Manage broker spread carefully: High spreads can erase small profits, so pick low-spread pairs and a reliable broker.

Breakout Strategy at the Start of the Asian Session

When the Tokyo session opens, the overnight range often breaks, creating a clean chance for larger moves. In Tehran time, Tokyo opens around 3:30 a.m., and volatility can noticeably increase right after. That makes the session open a prime window for breakout traders who prepare properly in advance.Simple Steps for Using the Overnight Breakout Strategy

- Define the overnight range clearly from the New York close until the Tokyo open using the session high and low.

- Accept only a real breakout, meaning a full candle closes outside the box, not just a wick.

- Enter after confirmation using one of two approaches, based on risk tolerance and trading style.

- Cautious traders wait for a retest of the broken edge, then enter once the price holds.

- Aggressive traders enter on the breakout close, but they reduce position size to control risk.

- Place the stop loss behind the range to avoid catastrophic losses if the price snaps back.

- For an upside breakout, put the stop slightly below the box low.

- For a downside breakout, put the stop slightly above the box high.

Pro Tip:

Set your first take profit equal to the box height, and consider a trailing stop for extended runs.

Best Currency Pairs and Trading Instruments for Overnight Trading

According to FXopen, choosing the right currency pair at night can significantly change trade quality and reduce avoidable execution problems. Each instrument has its own behaviour, so you should review its key traits before entering any position.- USD/JPY: This pair is highly traded at night because it aligns with Japan’s market opening in Asia. It often shows more predictable movement, making it popular for breakout strategies around the Tokyo open.

- AUD/USD and NZD/USD: Australia and New Zealand are closely linked to commodities, especially gold and raw materials. Early in Asia, their economic releases can trigger sharp moves, which suits traders focused on news-driven setups.

- EUR/CHF: This is one of the lower-volatility pairs, and it often works well for overnight scalping strategies. Thanks to higher stability, it usually produces small but reliable moves that support short-term trade opportunities.

- Gold (XAU/USD): Gold is generally considered a safe-haven asset, especially during periods of macro uncertainty and risk-off. Early Asia, and after major headlines, it can move fast, making overnight gold trading riskier but potentially rewarding.

Key Insight:

When choosing overnight instruments, consider liquidity and spread, but also match them to your trading style. Scalpers often prefer calmer pairs like EUR/CHF, while breakout traders tend to focus on USD/JPY or gold.

Risk Management in Overnight Trading

At night, lower market volume creates both solid opportunities and greater risk. That is why risk management matters more than the strategy itself during overnight forex trading sessions.

Using a Stop Loss

Always set a stop loss for overnight trades, because sudden news or thin liquidity can cause sharp price spikes. Without a stop loss, even a small move can threaten your entire account through slippage and uncontrolled loss.

Paying Attention to Swap Fees

When you keep a trade open into the next day, the broker applies an overnight fee called a swap. Some pairs have large negative swaps, and holding them for several nights can wipe out your profit completely.

Trade Management Tools

In MetaTrader, tools such as open-position management and trailing stop help you manage risk more effectively.

For example, once a trade turns profitable, a trailing stop moves your stop loss automatically to help lock in gains.

Trading Platform Stability

If MetaTrader becomes slow or freezes at night, you may miss entries or get delayed order execution. Improve speed by clearing cache, reducing open charts, and using a VPS for more stable connectivity.

Conclusion

Overnight forex trading suits traders who target tighter ranges or breakouts near the start of the Asian session. If you choose the right pair and strategy, and control stop losses and swap costs, nights can be profitable. The real keys at night are simple rules, patience, and strict trading discipline.