In successful trading, a clear and reliable trading setup is the difference between blind entries and disciplined decisions. Many beginners trade without a framework, and that lack of structure is a common reason losses keep repeating.

If you want a clear route for entries and exits, this guide explains trading setups in a simple, usable way.

You will learn how to design a profitable setup, understand common setup types, and avoid the mistakes that destroy performance. The goal is a system that can be profitable and still fits your trading style, schedule, and risk tolerance.

- A trading setup is not just a pattern; it is the output of your analysis, mindset, and personal trading logic.

- Matching a setup to your lifestyle timeframe, available hours, and behavioural profile is crucial for long-term consistency.

- Backtesting alone is not enough; live forward testing under real emotional pressure reveals a setup’s true value.

- The best setups are usually the simplest, while complexity often signals low confidence and unclear decision rules.

What is a trading setup, and why does it matter?

When you enter the market, you need clear rules rather than guesses. A trading setup is a set of predefined conditions. You must meet these specific requirements before you ever decide to take a trade. This structure helps you stay focused.

Key Elements of a Setup:

- Breakouts: Price moves above a strong resistance level.

- Moving Averages: Price moves above a specific average line.

- Candlestick Patterns: Specific shapes on a chart that signal a move.

Q: Why does the trading setup matter?

A: The true value of a setup is that it turns trading into a logical process instead of an emotional reaction. When your rules are explicit, the chance of making impulsive trades drops significantly. This makes your execution much more consistent.

Over time, this structure leads to steadier performance. It reduces the financial damage caused by making random or hurried decisions. A defined setup helps you act like a professional, allowing you to spot higher-quality opportunities with much greater clarity.

Example

Imagine the price is hitting a resistance level as pressure builds. If it breaks through on high volume, a setup forms. If you execute this plan consistently, it becomes a reliable part of your long-term strategy for success in the markets.

How is a trading setup different from a trading strategy?

Terms like trading setup and trading strategy are often mixed up, but they serve very different roles in trading. A setup is the specific, rule-based condition for entry or exit when all filters are satisfied.

Examples include a clean resistance breakout or a defined technical signal that meets your pre-set criteria.

A strategy, by contrast, is the broader framework that defines how you operate in markets day to day. It covers market selection, timeframe choice, risk management, and your trading style, such as trend-following or volatility-based trading.

Setup vs strategy at a glance

- Trading setup: the exact trigger you act on, with clear entry, stop-loss, and often a defined confirmation rule.

- Trading strategy: the complete plan that decides what you trade, when you trade, and how you control risk.

In simple terms: A setup is a component of a strategy and acts as its practical execution tool. The strategy is the roadmap, while setups are the building blocks that let you follow it consistently.

Example

A trend-following strategy may require you to trade only in the direction of the dominant trend. The setup activates only when price prints a valid trend-aligned breakout, ideally supported by rising volume.

Key Insight:

A trading setup is a set of market conditions that must be met before entering a trade, and it is usually part of a broader strategy.

Core principles for building a profitable trading setup

One of the first steps in learning trading setups is understanding the principles that underpin a robust, repeatable system. Simple, flexible setups aligned with your personal trading style usually perform better over time.

For example:

If you scalp, too many complex confirmations can delay execution and make you miss the move. A clean, fast, and unambiguous setup often improves discipline and makes your entries more precise.

Another key principle is to test your setup on historical data and then forward-test it in a demo account. This helps you spot weaknesses before risking real capital, and refine rules while market conditions are still “safe”.

By reviewing performance across different regimes and adjusting accordingly, you build a more coherent system.

In short:

A profitable setup should be simple, style-compatible, and validated on real market behaviour.

Below are four pillars that matter most when designing and executing a successful trading setup.

1) Choose the right timeframe for your setup

A large part of setup design is selecting a timeframe that matches your holding period and decision speed. Scalpers often use 1M or 5M charts, while swing traders lean on 4H or daily charts.

Q: Why does a trading setup need to match the timeframe you use?

A: Signals only matter when the chart context makes them meaningful. If your setup is a resistance breakout, test it on timeframes where breakouts are reliable, not just noisy spikes.

In markets like forex, aligning the timeframe with the market direction is especially important for cleaner entries and exits.

For more context, see our guide on Buy and Sell in Forex, which explains how time and direction shape execution.

2) Use technical tools to build a practical setup

Most tradable setups are built from a small set of simple, proven technical tools.

Moving averages help define trend, RSI measures momentum, and support/resistance maps key reaction levels.

For beginners, these tools work best in combination, not in isolation, because each tool filters different noise.

A practical starter combination could look like this:

- A moving average crossover to signal trend shift or trend continuation;

- RSI overbought/oversold behaviour to avoid late entries;

- A clear resistance area to define the trigger and the invalidation level.

At more advanced levels, you can blend indicators with price action to improve precision and flexibility. When tested properly, these combinations can materially lift your win rate and reduce low-quality trades.

3) Apply risk management and respect the risk–reward ratio

No matter how sharp your setup looks, weak risk management will eventually undermine sound decision-making.

The risk-reward ratio (for example, 1:2 or 1:3) defines how much you aim to make per unit of risk. Used alongside a clear stop-loss and realistic take-profit levels, it supports sustainable performance.

Example:

If you risk £50 on a trade and target £150 profit, your risk-reward ratio is 1:3.

That can be an attractive trade, but it still must fit the market’s volatility and current conditions.

4) Trading psychology and its impact on setup execution

Even the best setups fail when emotions hijack execution and rules become negotiable in the moment. Fear of loss or greed for extra profit often causes early exits, late entries, and stop-loss tampering. One of the simplest and most effective tools for control is a structured trading journal.

In your journal, record each trade and review the behavioural layer, not just the chart outcome:

- your entry and exit reasons, written in plain rule language;

- your emotional state before, during, and after the trade;

- whether you followed the setup rules, and exactly where you drifted.

This improves decision-making, reveals recurring mental errors, and builds the self-control needed for a setup to work.

Key Point

Instead of relying solely on historical data, test across multiple markets or similar instruments, like different forex pairs or comparable shares. This shows whether the setup holds up across varied conditions or was built for one specific environment.

Step-by-step guide to building a trading setup

To learn practical setup building, it helps to follow a patient, step-by-step process with clear rules. Systematic steps like testing, reviewing, and refining help you develop a profitable, dependable setup over time.

Experience shows that setup building needs repeated practice and improvements based on real data, not on live, emotional decisions.

Step 1: Analyse the market and define entry conditions

The first step in building a trading setup is a thorough market analysis. Use technical tools like candlestick charts and indicators, plus fundamental inputs such as key economic news. Define your entry condition clearly, such as a resistance breakout or a candlestick pattern like a pin bar.

For example:

If price breaks above resistance on strong volume, that can be your entry trigger. This analysis becomes the foundation of a robust, repeatable trading setup.

Entry condition checklist (examples):

- Price breaks a defined support or resistance level with a clean close;

- Volume expands versus recent bars, supporting breakout validity;

- A specific candlestick signal forms, such as a pin bar or engulfing candle;

- The broader market context matches your bias, such as trend direction or volatility regime.

Step 2: Set precise entry and exit rules

A usable setup needs precise entry and exit rules, not vague intentions. Your entry might be the break of a key level, or confirmation from an indicator such as RSI. For exits, use predefined price targets or indicator-based signals to reduce second-guessing.

For example, in an uptrend, you may exit at the next resistance level or when the RSI reaches overbought. This step helps you trade with intention and improves consistency across different market conditions.

Exit rule options (choose and define):

- fixed target at the next support or resistance zone;

- partial profit-taking at key levels, then trailing the remainder;

- indicator-based exit, such as momentum weakening or a reversal candle close.

Step 3: Define stop-loss and take-profit levels

Setting a stop-loss and take-profit is a critical part of any trading setup. A stop-loss protects you from large drawdowns, while a take-profit locks in gains with clear discipline.

For example, place the stop-loss 20 pips below support and target 60 pips above entry for a 1:3 ratio.

This approach keeps risk defined and helps your setup remain sustainable through normal losing streaks.

| Item | Example rule |

|---|---|

| Stop-loss | 20 pips below the support level |

| Take-profit | 60 pips above entry |

| Risk–reward | 1:3 |

Step 4: Test and optimise the setup in a demo account

Before trading live, test your setup in a demo environment to reduce avoidable mistakes. Backtesting on historical data shows how the setup would have performed across past market conditions.

Record outcomes in a trading journal to spot weaknesses and refine the rules objectively. This step builds confidence and reduces the urge to improvise when emotions rise in real markets.

What to log in your trading journal:

- entry trigger and confirmation used;

- stop-loss, take-profit, and position size;

- outcome, plus notes on execution quality and rule adherence.

Step 5: Implement the setup in live trading with controlled risk

After a successful demo phase, move to live trading with small, controlled capital and strict risk limits. Position sizing, discipline, and full adherence to setup rules matter more than finding “perfect” entries.

Q: Why should you start trading a new setup with small capital first?

A: Starting small keeps early mistakes inexpensive and reduces psychological pressure. It lets you gain real-market experience and refine the setup without forcing results. Over time, you can improve your tools and processes as your performance becomes more consistent.

Common types of trading setups

According to the XS website, when you design a successful trading system, you need to understand the main setup types and when each one fits. Each setup defines specific entry and exit conditions, and it suits different trading styles and time horizons.

Knowing these setups helps you spot cleaner opportunities across markets and avoid common execution mistakes. Some of the most widely used setups include breakout, pullback, price action, and indicator-based setups.

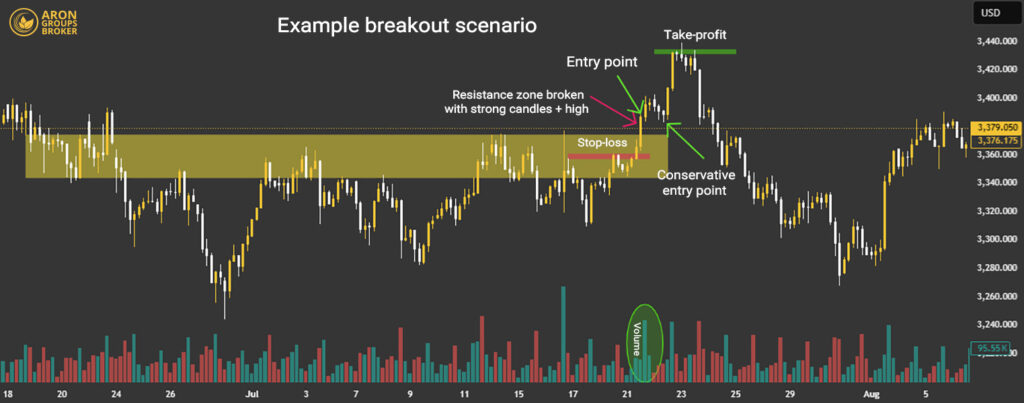

Breakout setup

A breakout setup triggers when the price moves through a key support or resistance level, ideally with rising volume.

For example, if price breaks above resistance and prints a strong candle on higher volume, that is a breakout setup.

- The main advantage is catching an explosive move early, before the trend becomes crowded and risk-reward compresses.

- The main risk is a false breakout, where the price breaks briefly, then reverses and traps late entries.

For that reason, breakout setups work best with added filters and clear invalidation rules.

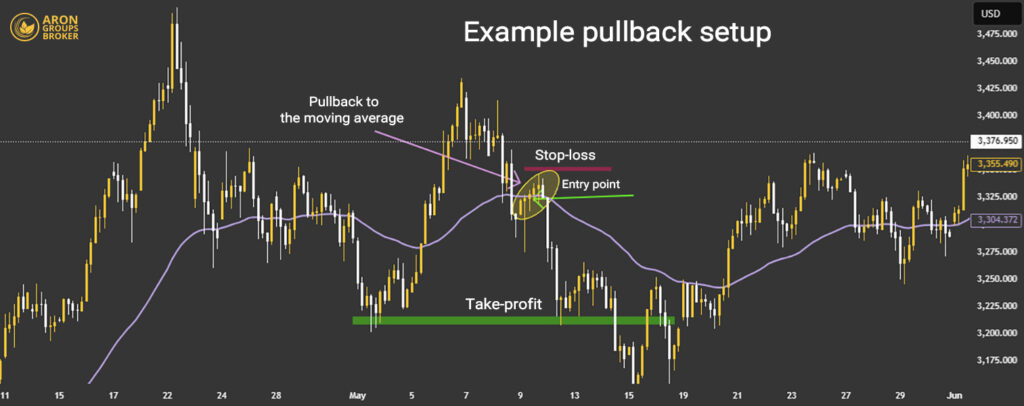

Pullback setup

A pullback setup is a trading setup where the trader enters during a temporary retracement within an existing trend.

For example, buying on a pullback to the 50-day moving average within an uptrend is a common approach. This setup suits more conservative traders because it carries less risk than breakouts and offers better entry prices.

Confirming the broader market trend is essential when using a pullback setup.

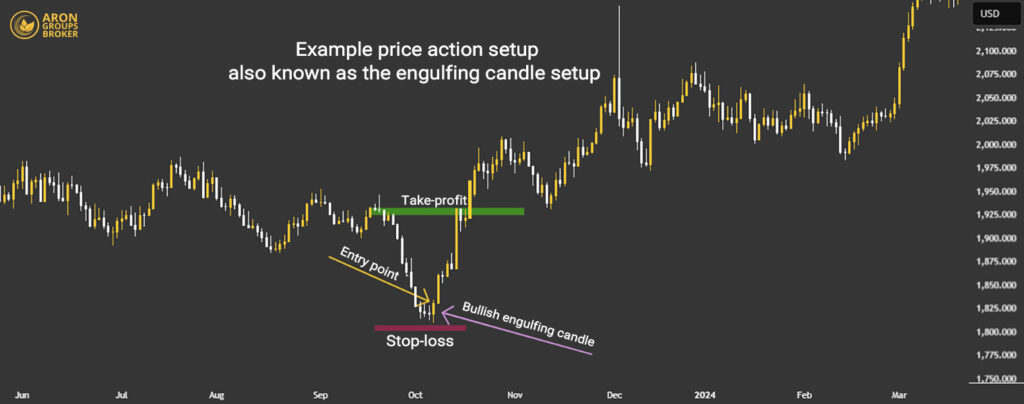

Price action setup

A price action setup is a trading setup that focuses on price behaviour rather than indicators. Candlestick patterns such as pin bars and engulfing patterns are common examples of this setup.

This approach is popular because it is simple and can be highly precise for technically focused traders. Using support and resistance levels can improve the effectiveness of a price action setup.

Indicator-based setup

An indicator-based setup uses tools such as RSI or MACD to identify trading signals.

For example:

Buying when RSI moves above the 30 level can be used as an entry signal. This setup suits beginners because it provides clearer, rule-driven signals for decision-making.

However, combining indicators with price analysis can improve accuracy and reduce poor-quality entries.

Comparing setup types by risk and return

- A breakout setup usually carries higher risk but offers greater potential return, because moves can be sharp and fast.

- A pullback setup tends to have lower risk and more average returns, because the entry occurs during a retracement.

- A price action setup, with simple execution and high precision, suits short-term or volatile trading conditions.

- An indicator-based setup suits traders who prefer clearly defined rules and more structured decision-making.

The best choice depends on your experience, risk tolerance, and trading style, and should be guided by backtesting.

Common mistakes when building and using a trading setup

On the path to a profitable trading setup, traders often repeat a few common errors that weaken overall performance. These include copying setups blindly, ignoring risk management, changing rules too often, and overcomplicating the structure.

To avoid these mistakes, learn the core principles first, then practise patiently in a demo environment until execution is consistent.

Using a setup without proper learning or understanding

One of the biggest mistakes is following setup training without genuinely understanding how the setup works. Many traders simply copy someone else’s setup without testing it properly in a demo account first.

This leads to trades taken without knowing the setup’s limits or the market conditions where it performs poorly. Always study the setup and gain hands-on experience before using it with real money.

Ignoring risk management

Ignoring a stop-loss or risking too much on a single trade are among the most common trading errors. Many traders enter without a defined stop-loss or a clear risk-reward ratio, which exposes them to outsized losses.

As a result, one bad trade can cause significant damage to the account. Even a precise setup can fail if risk is not controlled consistently.

Changing the setup too often and lacking patience

Constantly changing a trading setup based on short-term results can be seriously destructive. Traders often abandon a setup after a few losses or small wins, before it has a fair sample size.

Building a successful system requires time, long-term review, and commitment across different market conditions.

Using overly complex setups

Another common issue is using overly complex structures or combining multiple tools without clear alignment. That complexity creates confusion and increases execution errors, especially under real-time pressure.

Keep your setup simple, so it stays actionable, consistent, and easier to follow with focus and accuracy.

To understand cleaner entry and exit mechanics, read the article on the difference between Buy Limit and Buy Stop orders.

Key Point:

A common mistake is changing a setup after a few losing trades without testing it over a meaningful sample, such as 30 trades or one month. To build confidence through real performance, you must stick to a defined execution period.

Conclusion

Achieving consistent trading results without a defined and tested trading setup is almost impossible. For more stable outcomes, practise your setup in a demo account, start with small capital, and follow risk rules patiently.

Learning setup types and choosing one that fits your style, supported by reliable education, can reduce risk over time.