If you’ve ever wondered why Bitcoin, despite its higher price, surpasses Ethereum in market cap, or why a small company’s stock might carry more risk than a giant’s, the answer lies in market cap or market capitalization. This key metric helps investors determine how “valuable” an asset is in comparison to others, whether it’s a stock, cryptocurrency, or even Forex pairs. Market cap is not just a number; it’s a tool for assessing financial health, predicting market trends, and avoiding price bubbles. In this article, we’ll break down how market cap is calculated, why it matters, and how you can use it to build a stronger investment portfolio.

- Market cap shows how valuable a company is, calculated by multiplying the total number of publicly available shares by the current price of each share.

- Market capitalization helps assess a company's size and compare its financial performance with other companies, regardless of their size (large, small, or mid-cap).

- Investors use market cap to evaluate the relative value of companies and make more informed decisions about potential investments.

- Market cap is a crucial metric for comparing companies within the same industry or sector to understand their market standing.

What is Market Cap?

Market Cap or Market Capitalization refers to the total dollar value of a company’s shares or the total circulating supply of a cryptocurrency. The formula for calculating it is simple: current price × total number of shares or coins.

Market Cap or Market Capitalization is one of the most fundamental concepts in financial analysis, helping investors understand the size and importance of an asset or company. In simple terms, this metric is obtained by multiplying the current price of each unit of an asset by the total number of units in circulation. The formula for calculating market cap is as follows:

Market Cap = Current Price × Total Units in Circulation

This concept applies not only to the stock market but also to cryptocurrencies, gold, and even Forex. Understanding market cap helps you see how valuable an asset is compared to its competitors, even if the price of each unit is high or low on its own.

Why is Market Cap Important?

Market cap or market capitalization is one of the first metrics that professional investors use to evaluate the risk and growth potential of an asset. This key indicator not only helps determine the size of a project or company but also allows you to assess whether the current price of an asset is fair.

A solid understanding of market cap can significantly influence an investor’s decision-making process. It offers insights into the scale of an asset and aids in analyzing investment risks and price volatility patterns. To explore these key aspects, consider the following points:

- The impact of market cap on the risk and growth potential of assets.

- The role of market capitalization in analyzing market price volatility.

The Impact of Market Cap on Risk and Growth Potential of Assets

Assets with a large market cap, such as Bitcoin (with a crypto market cap over $1.8 trillion at the time of writing), typically have less volatility and are more suitable for long-term investments. This stability comes from their high liquidity and the broad investor trust they enjoy. On the other hand, assets with a smaller market cap, like Dogecoin (with a market cap of around $26.27 billion at the time of writing), may experience explosive growth but are also more prone to severe declines.

The Role of Market Cap in Analyzing Market Price Volatility

To fully understand the role of market cap in analyzing market price volatility, take the following examples into account:

- Crypto market cap: Bitcoin, with its large market cap, has a notable impact on the entire crypto market, even when experiencing a 10% price change. In contrast, altcoins like Dogecoin, despite having a low price per unit (typically around $0.10), have a relatively low market cap due to their high supply (148.97 billion tokens at the time of writing). This dynamic makes Dogecoin’s price volatility more driven by market sentiment rather than by fundamental factors.

- Market cap formula: When market cap grows steadily alongside an increase in price and trading volume, it often signals that larger investors are injecting capital into the asset, steering clear of the volatility that smaller assets face. In such cases, Bitcoin, with its high market capitalization, acts as a safer haven within the crypto market cap.

- Market cap vs enterprise value: On the flip side, altcoins like Dogecoin are more speculative and subject to short-term market excitement. The sudden surge in Dogecoin’s market cap is often the result of emotional investor behavior and can lead to both rapid price increases and sharp downturns, unlike assets with a more stable market capitalization.

As a result, market cap tells you:

- Whether an asset has real value or is driven by market excitement.

- Whether its price growth is sustainable or temporary.

How to Calculate Market Cap (Market Capitalization)?

To calculate market cap, follow these steps:

- Find the current price of the asset.

- Determine the total number of shares or coins in circulation.

- Multiply the price by the total number of units.

The market cap formula is simple:

Market Cap = Current Price × Circulating Supply

This formula is applicable to all types of assets, from cryptocurrencies to stocks and even gold. Let’s go over a few examples to understand how to calculate market capitalization.

Example 1: Calculating the Market Cap of Shiba

Suppose the price of one Shiba (SHIB) token is $0.00001, and its circulating supply is 549 trillion tokens.

Calculation:

$0.00001 × 549,000,000,000,000 = $5.49 billion

This calculation shows the market cap of Shiba and determines its position in the crypto market cap.

Example 2: Market Cap of Apple in the Stock Market

If the price of one Apple share is $180 and the total shares outstanding are 16 billion:

Calculation:

$180 × 16,000,000,000 = $2.88 trillion

This market capitalization places Apple in the Large Cap category, which we’ll cover in more detail later when discussing Large Cap vs Small Cap vs Mid Cap.

Example 3: Market Cap of Gold

To calculate the global market cap of gold, multiply the price of one ounce of gold (e.g., $1,800) by the global gold reserves (around 200,000 tons).

Convert tons to ounces: 200,000 tons = 6.4 billion ounces.

Calculation:

$1,800 × 6,400,000,000 = $11.52 trillion

This fully diluted market cap reflects the total value of gold based on its circulating supply and current price.

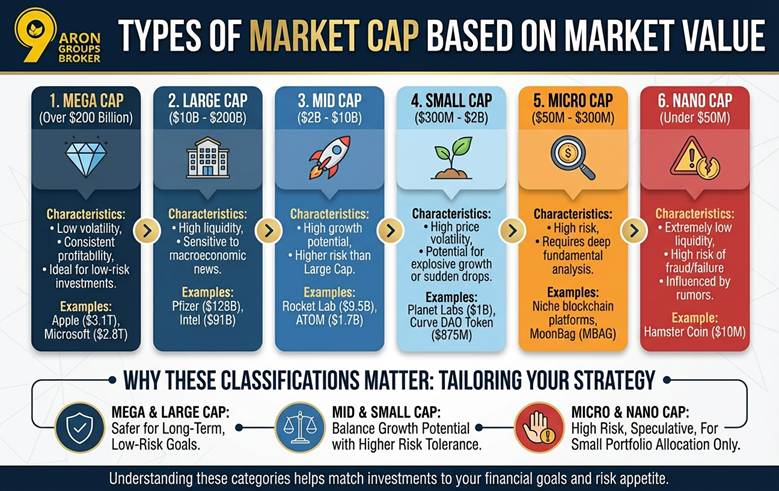

Types of Market Cap Based on Market Value

Categorizing projects or companies based on market cap helps investors assess risk levels, growth potential, and asset stability. These categories are typically divided into six main groups:

1. Mega Cap Market Cap (Over $200 Billion)

Assets with an exceptionally high market cap that play a crucial role in the global economy fall under the Mega Cap Market Cap category. Examples include:

- Apple (with a market capitalization of $3.106 trillion at the time of writing)

- Microsoft (with a market capitalization of $2.824 trillion at the time of writing)

Characteristics:

- Low volatility

- Consistent profitability

- Ideal for low-risk investments

2. Large Cap Market Cap (Between $10 Billion and $200 Billion)

Companies or assets with a large market cap represent a substantial portion of the market. Examples include:

- Pfizer (with a market cap of $128.37 billion at the time of writing)

- Intel (with a market cap of $91.35 billion at the time of writing)

Characteristics:

- High liquidity

- Sensitive to macroeconomic news

3. Mid Cap Market Cap (Between $2 Billion and $10 Billion)

Growing companies or projects that have not yet fully matured fall into the mid cap market cap category. Examples include:

- Rocket Lab (with a market cap of $9.46 billion at the time of writing)

- Cryptocurrencies like ATOM (Cosmos) (with a market cap of $1.69 billion at the time of writing)

Characteristics:

- High growth potential

- Higher risk than large cap market cap

4. Small Cap Market Cap (Between $300 Million and $2 Billion)

Startups or projects in the early stages of development generally have a small market cap. Examples include:

- Planet Labs (with a market cap of $0.97 billion at the time of writing)

- DeFi tokens with specific use cases like Curve DAO Token (with a market cap of $875 million at the time of writing)

Characteristics:

- High price volatility

- Potential for explosive growth or sudden price drops

5. Micro Cap Market Cap (Between $50 Million and $300 Million)

Very small projects with limited trading volume that typically operate in niche markets are classified under the micro cap market cap category. Examples include:

- Niche blockchain platforms (blockchains designed for specific use cases, such as Roobee, an AI investment platform for everyday users)

- Native tokens with small user communities, like the meme coin MoonBag (MBAG)

Characteristics:

- High risk

- Requires deep fundamental analysis

6. Nano Cap Market Cap (Under $50 Million)

Assets with negligible market capitalization, often in the early or experimental stages, fall into the nano cap market cap category. Example:

- Hamster Coin (HAMSTR) with a market cap of around $10 million

Characteristics:

- Extremely low liquidity (even small asset sales could cause a price crash)

- High risk of fraud or project failure

- Often influenced by rumors or pump-and-dump schemes

Why Are These Classifications Important?

Understanding these classifications allows you to tailor your investment strategy based on your risk tolerance and financial goals. For instance:

- Small Cap and Nano Cap assets are generally appealing to risk-seeking traders but may have low trading volumes, making it harder to exit positions.

- Mega Cap Market Cap assets like gold or Apple stocks are safer for long-term investments.

- Projects with nano cap market cap, such as Hamster Coin, should make up only a small part of your investment portfolio.

The Impact of Market Cap on Liquidity and Market Volatility

For a more accurate market analysis, it’s important to consider the relationship between market cap, trading volume, and market depth, as these factors influence price behavior and volatility.

An asset with a high market cap might still have low liquidity. This means that, even though the total value of the asset is large, its trading volume may be low, leading to higher price volatility and difficulty in buying or selling large amounts without causing significant price changes.

For example, in the crypto market, the APE token initially had a very high market cap, but a significant portion of its tokens were still locked in contracts or held by the development team. As a result, liquidity was low, and even small transactions could lead to significant price fluctuations.

Similarly, Berkshire Hathaway’s Class A shares (BRK.A) have a very high market cap, but low liquidity. The main reason for this is the very high price of each share (at the time of writing, each Class A share of Berkshire Hathaway is trading at $795,999), which means that only a limited number of investors are able to trade it. This share is an example of a traditional asset with a large market cap, but a low daily trading volume.

It's important to note that a high market cap does not necessarily equate to high liquidity. Market cap indicates the overall size of an asset, while liquidity refers to how easily that asset can be bought or sold without significantly affecting its price.

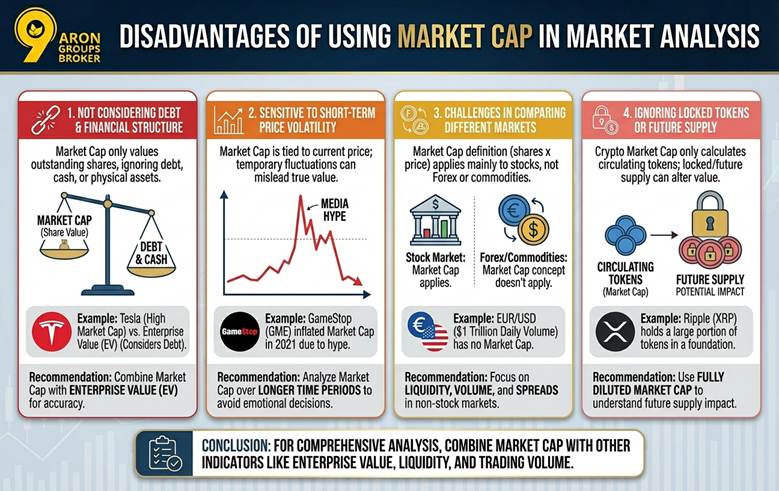

Disadvantages of Using Market Cap in Market Analysis

While market cap is a key indicator in financial market analysis, relying solely on this metric can lead to poor decision-making. Below, we explore the key limitations of market cap.

1. Ignoring Debt and Financial Structure

Market cap only calculates the value of outstanding shares or tokens and does not consider debt, cash reserves, or physical assets. This is where the Enterprise Value (EV) metric becomes important.

Enterprise Value (EV) is a metric that, in addition to market cap, also takes into account a company’s debt, cash reserves, and preferred stock.

Example:

A company like Tesla may have a high market cap, but if its debts are factored in, the enterprise value (EV) of the business may differ significantly. Therefore, to get a more accurate picture, analysts should combine market cap with other indicators such as EV.

| Metric / Indicator | Market Cap | Enterprise Value (EV) |

|---|---|---|

| Definition | The total market value of a company's shares | The estimated true value of a company, factoring in debt and other financial elements |

| Formula | Current price per share × total shares outstanding | Calculated using discounted cash flow (DCF) models or other valuation methods |

| Application | Measures a company’s size in the market and compares it with others | Helps assess whether a company is undervalued or overvalued by considering its true value |

| Advantages | Simple, fast, and easily understandable for investors | More accurate, based on deeper financial analysis |

| Disadvantages | Can be influenced by market fluctuations, lacks consideration of fundamentals | Requires assumptions and estimates, leading to higher analytical error |

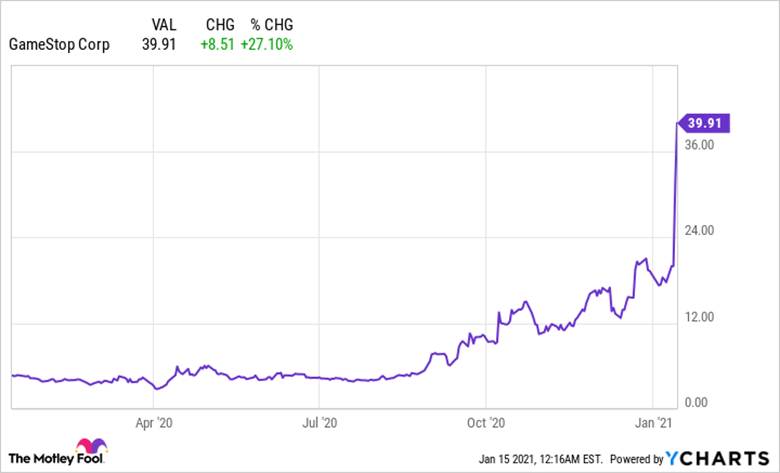

2. Sensitivity to Short-Term Price Volatility

Market cap is directly tied to the current price of the asset. Temporary price fluctuations can create a misleading picture of the asset’s true value.

Example:

In January 2021, GameStop’s market cap (GME) spiked dramatically due to media hype and retail investor activity, but this surge was not sustainable. To avoid emotional decision-making, it’s better to analyze market cap over longer periods.

3. Comparing Market Cap Across Different Markets

In traditional markets such as Forex or commodities (like gold), market cap doesn’t hold the same meaning. In these markets, liquidity and trading volume are more important factors.

Market Cap (or market capitalization) typically refers to the total value of a company in the stock market, calculated by multiplying the number of shares by the current price per share. This definition is primarily applicable to the stock market and companies.

Example:

In Forex, the EUR/USD currency pair has the highest liquidity, with daily trading volumes reaching $1 trillion. However, market cap doesn’t apply in this context. In such markets, focusing on liquidity, spreads, and volatility is more useful than relying on market cap.

4. Ignoring Locked Tokens or Future Supply

In the cryptocurrency market, market cap only considers the circulating tokens, but locked tokens or future supply can drastically change the asset’s value.

Example:

Projects like Ripple (XRP) hold a significant portion of their tokens within a foundation. The release of these locked tokens could significantly affect the market cap.

Using the fully diluted market cap, which we will explain later, is essential for understanding the impact of future token releases.

While market cap is a helpful tool for making initial asset comparisons, it is crucial to combine it with other indicators like liquidity, trading volume, and enterprise value for a more comprehensive analysis. Especially in markets where market cap and liquidity differ significantly, these metrics offer better alternatives for evaluation.

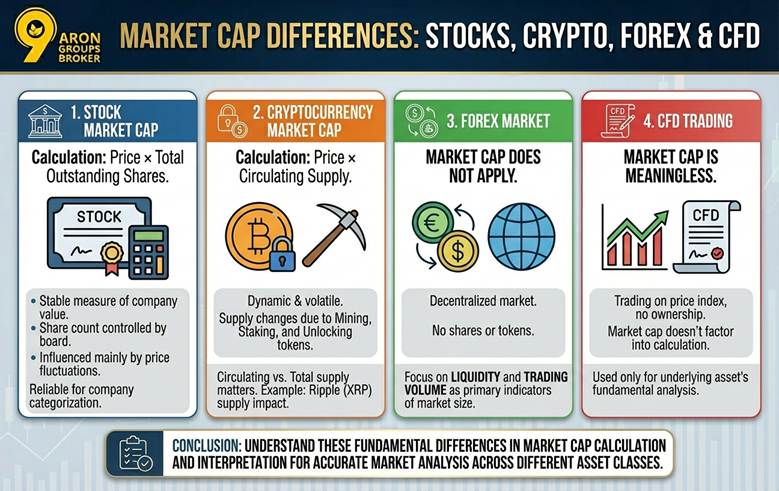

The Difference in Market Cap in Stock Markets and Cryptocurrencies

At first glance, the concept of market cap or market capitalization seems similar across various financial markets: price multiplied by the number of units available. However, the reality is that there are fundamental differences in how this metric is calculated, interpreted, and its stability in the stock market, cryptocurrency market, and Forex. Understanding these differences is essential for analysts and professional investors.

Market Cap in the Stock Market

In the stock market, market cap is calculated by multiplying the current price per share by the total number of shares outstanding. This number is used as a relatively stable measure of a company’s total value. Since the number of shares outstanding is typically controlled by the board of directors and only changes under specific conditions, market cap in the stock market is more influenced by share price fluctuations. This makes market cap in stocks a reliable indicator for categorizing companies (such as large, mid, or small-cap companies) and comparing their value over time.

Market Cap in the Cryptocurrency Market

However, in the cryptocurrency market, the story is quite different. Here, instead of shares, we deal with tokens or coins, and market cap is calculated based on “token price × circulating supply.” The circulating supply represents only a portion of the total tokens that could eventually exist.

The main difference lies in the fact that the token supply may change over time due to mechanisms like mining, unlocking of locked tokens, or staking mechanisms. Therefore, market cap in the crypto world is far more dynamic and, at times, more volatile.

For example, a project like Ripple (XRP) has a total supply of about 100 billion tokens, but only around 45 billion of those are in circulation. If some of the locked tokens are injected into the market, even if the price remains unchanged, it can suddenly impact the market cap. Additionally, projects like TapSwap, which temporarily remove some of their tokens through staking, can reduce the circulating supply and artificially inflate their market cap.

Market Cap in Forex and CFD Trading

In the Forex market, unlike in the stock and cryptocurrency markets, market cap does not directly apply. The reason for this is the decentralized nature of the Forex market. In Forex, various currencies are traded against each other, and trading volume and liquidity are the primary indicators used to measure the “market size.”

In CFD trading, market cap is directly meaningless. Since there are no tokens in circulation, traders do not own any specific shares or currencies, and they are simply trading on the “price index” of an asset. However, if a trader uses CFDs for assets like stocks or cryptocurrencies, the market cap of that asset may play a role in their fundamental analysis, but it doesn’t factor into the main calculations in the CFD trade itself.

The impact of news on market cap is not the same across markets. In crypto, reactions are often quick and sharp, whereas in the stock market and Forex, price fluctuations tend to be more gradual and are driven more by macroeconomic decisions, such as interest rates or monetary policies.

Factors Influencing Market Cap and Its Changes

Market cap or market capitalization is a dynamic metric influenced by multiple factors. Understanding these factors helps investors predict future trends and make more informed decisions.

One of the main factors is price changes. For example, after Ethereum’s “Merge” update in 2022, the price of the cryptocurrency increased, resulting in a significant growth in Ethereum’s market cap. This shows how technological upgrades to a project can attract investor confidence and increase its market capitalization.

Supply and demand also play a key role. For Bitcoin, the “halving” event, which occurs every four years, reduces the supply of new coins. This reduction in supply, combined with constant or increasing demand, typically leads to price increases and, consequently, a rise in Bitcoin’s market cap.

On the other hand, fundamental news can quickly alter market cap. The collapse of the Luna project in May 2022 is a prime example. The failure of the Terra (UST) algorithmic stablecoin and its loss of the dollar peg caused Luna’s market capitalization to plummet from tens of billions of dollars to nearly zero in just a few days. This event highlighted that even seemingly stable projects can crash due to negative news.

Other projects, like Toncoin (TON) and Solana (SOL), are not exempt from these rules. Solana’s market cap growth in 2021 was primarily driven by the development of its ecosystem and the attraction of DeFi projects, while Toncoin’s market capitalization was impacted by legal challenges and network limitations.

Ultimately, the combination of these factors (price, supply and demand, and news) is the primary driver of market cap fluctuations in financial markets. Understanding these elements not only aids in trend analysis but also helps avoid emotional decision-making.

Fully Diluted Market Cap

Fully diluted market cap is a metric that calculates the market value of an asset assuming all possible tokens or shares are issued. Unlike the regular market cap, which only considers circulating tokens, this metric also includes the projected maximum supply. This concept is especially important in cryptocurrency projects, where some tokens may not yet be mined, locked, or may be held by the development team.

For example, let’s assume NatCoin has a maximum supply of 100 million tokens, and the current price of each token is $5. If only 50 million tokens are in circulation, its regular market cap would be calculated as $250 million. However, the fully diluted market cap of this project, when you multiply the price by the maximum supply, would reach $500 million. This number indicates what the market cap of NatCoin would be if all possible tokens were released into the market.

This metric helps investors assess the potential impact of future supply on the price. For instance, if a project like NatCoin decides to release the remaining tokens, the increased supply could lead to a decrease in the price of each token. Therefore, the fully diluted market cap is a crucial tool for understanding long-term risks and strategic planning.

CoinMarketCap: The Most Trusted Source for Checking Crypto Market Cap

CoinMarketCap is recognized as one of the most reliable and widely used platforms for tracking data related to cryptocurrencies. This website not only displays the market cap of projects in real-time but also provides information such as trading volume, circulating supply, and price changes. For example, if you want to check the market cap of Baby Doge or the market capitalization of Dogecoin (DOGE), CoinMarketCap is the first platform that comes recommended.

Using this platform is simple: just type the name of the cryptocurrency you are interested in into the search bar.

For instance, searching for Baby Doge will take you to the dedicated page for this project, where you can see its market cap, current price, 24-hour trading volume, and its market rank. These data help you assess the project’s standing compared to its competitors.

Additionally, CoinMarketCap offers tools for analyzing overall market trends. For example, by visiting the “Total Market Cap” section, you can review changes in the market capitalization of Dogecoin and other cryptocurrencies over different time periods. These tools help investors make more informed decisions by providing a better understanding of the current market conditions.

The Most Important Market Cap Indicators in TradingView

TradingView is one of the most powerful technical analysis platforms, offering a variety of tools to track the market cap of cryptocurrencies and related indicators. One of the most useful tools is the Total Market Cap Chart, which displays the changes in the total market capitalization of all cryptocurrencies.

This chart collects real-time data from various projects and provides a general overview of market trends. For example, when the total market cap of crypto rises from $1 trillion to $2 trillion, the chart clearly shows that the market is in a bullish phase. Conversely, a significant decline in this indicator could signal the start of a bearish phase.

Analysts use this tool to identify market cycles. For example, in April 2021, the Total Market Cap Chart recorded unprecedented growth, which coincided with the influx of large-scale investments into the market. This data helped traders predict key resistance and support levels.

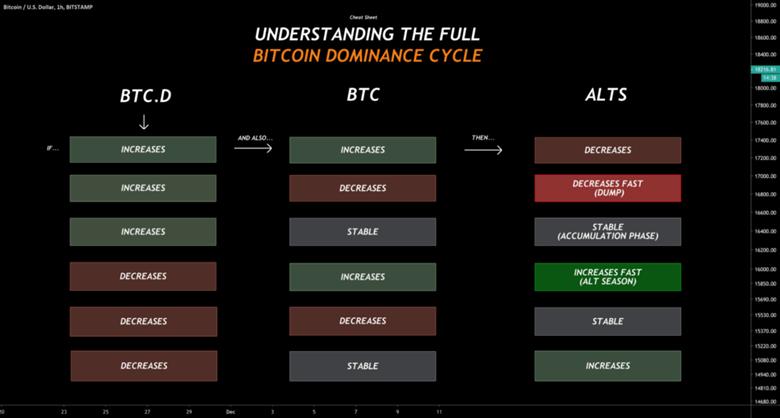

Additionally, TradingView allows users to compare the total market cap of cryptocurrencies with other indicators like trading volume or Bitcoin’s dominance. For instance, if the market cap is growing, but Bitcoin’s dominance is decreasing, it can be concluded that altcoins are attracting more investment.

How to Use Market Cap to Choose the Right Assets

Smart use of market cap can help you select assets that align with your risk tolerance and financial goals. One of the most common strategies is to diversify investments across assets with different market caps. For example, investing in mega market cap assets like Bitcoin or Ethereum, due to their relative stability and high liquidity, is a safe option for the more conservative part of your portfolio. These assets generally have less volatility and offer predictable returns in the long term.

On the other hand, small cap market cap projects like Major Coin or X Empire may have explosive growth potential but come with higher risk. These assets are often in the early stages of development and have a lower market capitalization, so an increase in demand can rapidly push their prices up. However, you should be cautious as such projects can be highly susceptible to extreme volatility or negative news.

It’s also essential to combine market cap with other indicators, like trading volume. For instance, a project with a high market cap but low trading volume (like some niche tokens) may have low liquidity, making it difficult to exit positions.

Additionally, understanding the difference between market cap and enterprise value (EV) is crucial when analyzing stocks. EV, which accounts for debt and cash reserves, provides a more accurate picture of a company’s true value. This distinction is especially important for projects like X Empire, which may have hidden debts, making market cap vs enterprise value an essential factor in your analysis.

Q: Why is comparing market cap to enterprise value (EV) important for stocks?

A: Market cap shows the company’s equity value, while EV accounts for debt and cash reserves. Comparing both reveals the true financial health and potential hidden risks, especially in small-cap or leveraged companies.

Conclusion

Market cap serves as a key tool in evaluating the market value of assets and plays a crucial role in financial decision-making. This metric not only determines an asset’s position compared to its competitors but also helps in understanding its growth potential and risk level. However, success in financial markets requires combining market cap with other analytical indicators such as trading volume, price, and liquidity.