In the world of forex trading, professional traders are constantly looking for strategies to profit from complex and deceptive market movements. One of these powerful strategies is the Judas Swing, also known as the “betrayer swing” for its misleading nature. In this article, we will comprehensively explore the Judas Swing strategy, how to identify it, and how to trade it. Our goal is to equip you with the tools and knowledge to avoid market traps. So, stay with Aron Groups until the end of the article.

- The Judas Swing is a price action strategy for identifying fake price moves and capturing market traps (stop hunting).

- The best time to use this strategy is during the London session (10:30 AM to 6:30 PM Iran time).

- This strategy doesn't require complex indicators and focuses on price movements and candlestick patterns.

- The Judas Swing can be applied to various timeframes, from short-term to long-term, and relies on market structure analysis.

What is the Judas Swing Strategy in Price Action?

The Judas Swing strategy is a key concept in ICT price action, developed by Michael Huddleston. This strategy focuses on identifying deceptive market moves designed to trigger stop-loss orders among retail traders. The Judas Swing is defined as a temporary market reversal that usually occurs in the opposite direction of the primary trend, misleading amateur traders. This move is often accompanied by stop hunting, where market makers manipulate prices to gather liquidity.

Judas Swing typically occurs in specific time zones, such as the Forex kill zone, where liquidity is high and volatility is high. This strategy helps traders avoid market traps and profit by analysing price behaviour and identifying specific patterns.

Key Insight

Unlike many price action strategies that focus on long-term trends, the Judas Swing is designed to exploit short-term moves. It allows traders to capture meaningful profits within limited windows, such as one to two hours.

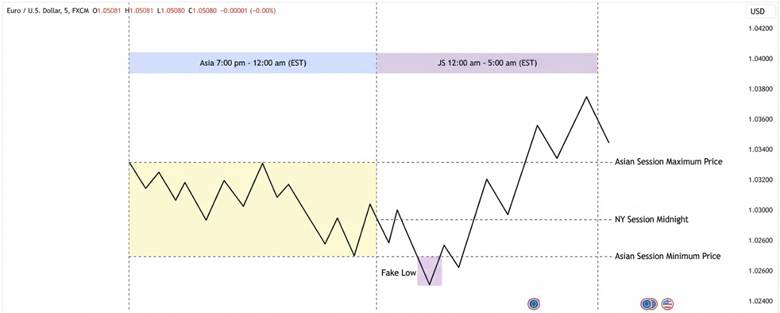

London Judas Swing Structure

The London Judas Swing refers to deceptive moves often occurring during the London trading session. This type of Judas Swing is particularly important due to high liquidity and extensive market maker activity in this session. Let’s explore the details of this structure.

Why Does Judas Swing Often Happen in the London Session?

The London session, the most significant Forex kill zone, is prone to fake moves due to high trading volume. Large market players like banks and financial institutions are also present.

Stop hunting during this period, especially between 08:30 to 13:30 Tehran time (07:00 to 12:00 GMT), is quite common. Market makers use this opportunity to create fake moves, triggering retail traders’ stop losses and gathering liquidity.

The London Judas Swing typically forms after the London market opens and reacts to key levels like the Asia session’s high or low.

Q: How Can Seasonality and Month-End Liquidity Influence Judas Swing Patterns?

A: Certain days, like the last trading day of the month or quarter, show heightened stop-hunting activity due to institutional portfolio adjustments. Seasonal patterns in Forex, such as summer low-liquidity periods, can make fake moves sharper but shorter. Traders who integrate seasonality and liquidity cycles into their Judas Swing analysis can time entries more precisely and avoid traps that only appear under specific calendar conditions.

Best Timeframes for Identifying the Judas Swing

The best timeframes for identifying the Judas Swing are the 5-minute and 15-minute charts. These timeframes are ideal because they provide a precise view of the market’s quick, deceptive movements. The Judas Swing usually occurs at the start of major sessions, such as London or New York, and is completed within 30 to 60 minutes.

If we want to identify the Judas Swing correctly, higher timeframes like the 1-hour and 4-hour charts hide these vital details. The 5-minute and 15-minute charts allow us to see the initial fake move. They also help identify the reversal point and structure break (BOS) accurately.

In practice, it’s recommended to first analyze the overall session structure on the 1-hour timeframe. Then, switch to the 15-minute or even 5-minute timeframe to precisely spot the Judas Swing. If you need precise entry with a small stop, the 3-minute or 1-minute timeframes can be useful. This is provided you have enough experience in market structure analysis.

Q: How Can Multi-Timeframe Confluence Improve Judas Swing Entries?

A: Multi-timeframe confluence greatly increases trade accuracy. Align the 15-minute Judas Swing setup with higher timeframe key levels, such as support and resistance levels, order blocks, or fair value gaps(FVG). This confirms that short-term fake moves occur at structurally significant zones, filtering out low-probability trades. Traders using this approach can achieve cleaner entries, smaller stop losses, and improved risk reward ratios.

How to Identify the Judas Swing at the Start of the London Market

Identifying the London Judas Swing requires focusing on unexpected price movements at the start of the London session. This pattern begins with a false move, such as a break of the Asian session’s high or low, and then quickly reverses.

Candlestick patterns like pin bars or engulfing patterns play a crucial role in confirming stop hunting. Traders should pay attention to key areas like order blocks or Fair Value Gap (FVG) regions to spot these movements.

Key Insight

In the London session, the overlap with the New York session (between 11:30 AM to 3:30 PM GMT) increases volatility. This boosts the likelihood of a Judas Swing due to the simultaneous activity of European and American banks.

How to Identify the Judas Swing on the Chart?

To identify the Judas Swing on charts, traders use price action analysis, drawing tools, and specialized indicators. Let’s explore the methods.

How to Spot Fake Highs and Lows as an Early Signal of the Judas Swing

Fake Highs/Lows are early stop hunting signs in the Judas Swing. These occur when price falsely breaks a key level, then reverses. Traders identify support, resistance levels, or order blocks for spotting these patterns.

These areas gather stop losses from retail traders, targeted by institutions for stop hunting. Patterns like pin bars or engulfing patterns confirm the move.

Tools for Confirming the Judas Swing

To confirm the Judas Swing, tools increase accuracy, but price action analysis is prioritized. The PO3 indicator identifies high liquidity areas. It helps predict stop hunting by locating accumulated orders.

The TradingView platform with horizontal lines and Fibonacci zones allows marking key levels. Order blocks or Fair Value Gaps (FVG) can identify entries. The Judas Swing focuses on price action and market structure, not complex indicators.

Key Insight

Using the ATR indicator alongside the PO3 indicator can help identify the intensity of a fake move. The Judas Swing is usually accompanied by a sudden increase in ATR on shorter timeframes.

Q: How Can Order Book Imbalance Signal a Judas Swing Before It Happens?

A: When buy or sell orders suddenly outnumber the opposite side in the order book, it can indicate a possible upcoming stop hunt. Traders can monitor Depth of Market (DOM) and large block orders to spot hidden liquidity areas. Combining this with short-term ATR spikes and small market structure shifts helps traders enter before the fake move happens, instead of reacting after it occurs.

Difference Between Judas Swing, Fake-out, and False Breakout

The Judas Swing, fake-out, and false breakout differ. A fake-out breaks a key level, but quickly reverses. The Judas Swing is a specific fake-out used for stop hunting in high liquidity zones.

False breakouts occur randomly at any time, while Judas Swings form during volatile sessions like London, with high volume. A false breakout may just break resistance. The Judas Swing includes a quick move and strong reversal, targeting stop losses.

Step-by-Step Guide to Trading with the Judas Swing Strategy

Trading with the Judas Swing strategy requires careful planning and consistent execution. This section explains the steps in detail.

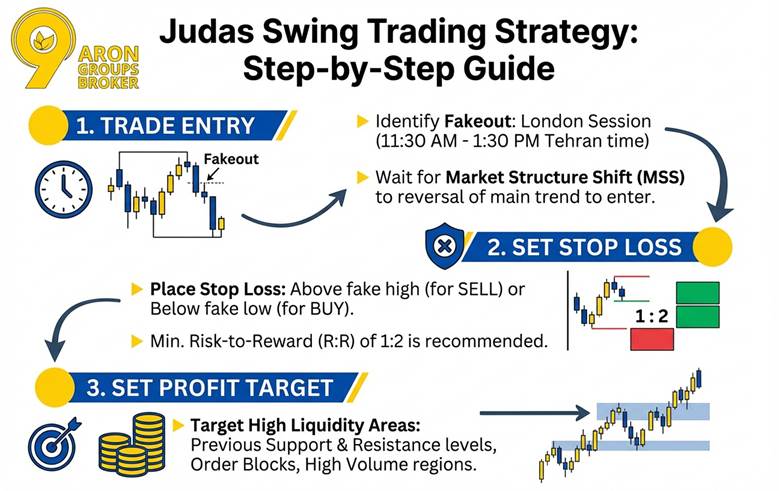

Steps to Enter a Trade After a Fakeout

To enter a trade with the Judas Swing strategy, first identify a valid fakeout. The fakeout typically occurs in the London session between 11:30 AM and 1:30 PM Tehran time. After identifying the fakeout, wait for a market structure shift (Market Structure Shift) to signal the reversal of the main trend. Once this shift occurs, enter the trade.

How to Set a Stop Loss in Judas Swing

Risk management is vital in the Judas Swing strategy, and setting a stop loss (Stop Loss) plays a key role. Place the stop loss above the fake high (for sell positions) or below the fake low (for buy positions) to avoid unexpected price swings. It is recommended to use a risk-to-reward ratio (R:R) of at least 1:2, ensuring the potential reward is at least twice the risk. This approach helps traders preserve their capital even with consecutive losses.

Setting a Target Based on Liquidity

To set a profit target in the Judas Swing strategy, identify high liquidity areas. These areas typically include previous support and resistance levels, order blocks, and regions with high trading volume. After identifying these areas, you can place your profit target near them.

Advantages and Disadvantages of Using the Judas Swing Strategy

The Judas Swing strategy is highly effective due to its accuracy in identifying market traps, especially in high liquidity areas like support and resistance levels. This method is ideal for volatile markets like Forex, especially during the London and New York sessions. Stop hunting is more common in these periods.

Additionally, the strategy doesn’t require complex indicators, simplifying analysis by focusing on pure price action. For example, a successful trade with the Judas Swing involves identifying a fakeout in the London session. Enter a sell position, yielding a significant profit with a 1:3 risk-to-reward ratio.

Despite its advantages, the Judas Swing strategy requires extensive experience and practice to accurately identify stop hunting patterns. Beginner traders may make mistakes when identifying false moves, especially on shorter timeframes like the 5-minute chart, where high volatility can lead to errors.

Furthermore, trading during volatile sessions like London carries high risks, as fast price movements can easily trigger stop losses. An unsuccessful trade may occur when a trader mistakes a false move for the main trend. They enter too early, and the price reverses, leading to a loss.

Advantages and Disadvantages of Using the Judas Swing Strategy

The Judas Swing strategy is effective for identifying market traps, especially in high liquidity areas like support and resistance. It works well in volatile markets like Forex, particularly during the London and New York sessions. Stop hunting is more common in these periods.

This strategy doesn’t require complex indicators, simplifying analysis by focusing on price action. A successful trade could involve identifying a fakeout in the London session and entering a sell position. This could yield a profit with a risk-to-reward ratio of 1:3.

Despite its advantages, the Judas Swing requires experience and practice to identify stop hunting patterns. Beginners may make mistakes when spotting false moves, especially on short timeframes like 5 minutes. High volatility can lead to errors.

Additionally, trading during volatile sessions like London carries higher risks. Fast price movements can easily trigger stop losses. An unsuccessful trade may occur if a trader enters too early, mistaking a false move for the main trend. This could result in a loss.

| Advantages | Disadvantages |

|---|---|

| High accuracy in identifying market traps | Requires experience and extensive practice |

| Suitable for volatile markets | High risk during volatile sessions |

| Doesn't require complex indicators | Potential errors on shorter timeframes |

Conclusion

The Judas Swing strategy is a powerful tool in price action analysis that helps Forex traders identify and exploit market traps. This strategy is especially effective in volatile markets, such as the London and New York sessions, thereby improving profitability. However, success with the Judas Swing requires experience and practice. Accurately identifying stop hunting patterns and false moves requires market knowledge and continuous chart analysis.

Traders are advised first to test this strategy on a demo account to learn how to identify fakeouts and set entry/exit points. After mastering the strategy in a risk-free environment, they can use it in a live account. Ultimately, the Judas Swing is an effective tool for avoiding market traps and can enhance trade accuracy and profitability.